http://www.mt5.com/forex_analysis/ https://www1.gotomeeting.com/en_US/island/webinar/registrationPost.tmpl?Action=rgoto&_sf=2 __ webminar by Kathy

http://www.investing.com/currencies/eur-usd-technical

http://www.investing.com/currencies/eur-usd-technical

pish9: พีชเคยทำแต่ไม่ได้ต้มนะ เอาใส่หม้อข้าวที่ใกล้จะสุก ล้างไข่ให้สะอาดแล้วใส่ถุงพลาสติก เอาไปวางไว้บนข้าวในหม้อ ประมาณ 5 นาที จะเป็นยางมะตูม

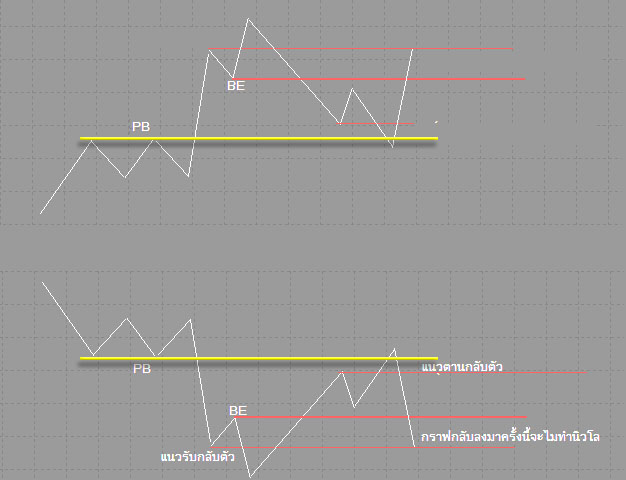

ฝรั่งเรียก เบรค อีเว้น ระยะเบรค เท่าทุน เสมอตัว คือถ้าเรา ชอท ระยะ เบรคอีเว้น แล้วกราฟเด้งหนีขึ้นบน แต่ก้ไม่นานครับ กราฟจะย้อนลงมาหาเบรค อีเว้น อีกครั้ง เราก็ ได้ปิด ชอทครับ เอาเสมอตัวไว้ก่อน แล้วค่อยหาทางเข้าใหม่ ครับ มันมีกฏ อยู่ว่า เมื่อท่าน ชอท ตรง BE แล้วกราฟเด้งหนี ขึ้นบน ท่านไม่ต้องตกใจครับ อีกไม่เกิน 48ชั่วโมง กราฟจะย้อน มา ที่ BE เสมอๆ

ฝรั่งเรียก เบรค อีเว้น ระยะเบรค เท่าทุน เสมอตัว คือถ้าเรา ชอท ระยะ เบรคอีเว้น แล้วกราฟเด้งหนีขึ้นบน แต่ก้ไม่นานครับ กราฟจะย้อนลงมาหาเบรค อีเว้น อีกครั้ง เราก็ ได้ปิด ชอทครับ เอาเสมอตัวไว้ก่อน แล้วค่อยหาทางเข้าใหม่ ครับ มันมีกฏ อยู่ว่า เมื่อท่าน ชอท ตรง BE แล้วกราฟเด้งหนี ขึ้นบน ท่านไม่ต้องตกใจครับ อีกไม่เกิน 48ชั่วโมง กราฟจะย้อน มา ที่ BE เสมอๆ

ตอนนี้ อียู บิน ขึ้นมาเจอ แนวต้าน ที่เคยกลับ ตัว ไป สองครั้งแล้ว รอบนี้รอบที่สาม ผมมองว่า ตอนนี้ เมื่อขึ้นไมาเจอ แนวต้านกลับตัว ในครั้งนี้ อาจจะแค่ ย่อลงมาพัก ไม่มาก นัก วันนี้ ผม มองไป ที่นิวไห ครับ นิวไห เพื่อ ทำ แนวต้าน ไว้กลับตัว อีกครั้ง ขอให้ทุกท่าน ระวัง จังหวะ หลวมๆ ลักษณะ กราฟ ทำ SHS ด้วยนะครับ คือ ก่อน ที่กราฟ จะทำ SHS กราฟ วางแผน หลอก ทำ BE ไว้ ก่อน จากนั้น กราฟบินทำแพทเทิ่ล SHS เมื่อทำเสด แล้ว ใครที่ ประสบการณ์ น้อยในตลาด แห่งนี้ ก็มองว่า เมื่อกราฟทำ SHS เสด แล้ว กราฟ จะเท แรง แต่ กราฟ ไม่เทครับ บินกระจาย ที่ไม่เท เพราะด้าน ล่างกราฟ ทำ BE เป็น แนวรับ ไว้แล้ว ระวังด้วยครับ กราฟชอบทำบ่อยๆxxx

Book Review and Recommendation The Little Book of Currency Trading is an excellent primer on currency trading. It is part of the Little Book series, from which I’ve read some good and less-good books, but this is one of the good ones. It explains the role of currencies in life and business, gives a brief overview of the currency market and includes sections such as “A-Z of Forex” and “Top 10 Mistakes.” Kathy touches on market participants, fundamentals and technicals, scams to watch out for, trade planning, and she recommends some trade identification methods. I would recommend the book to someone was thinking about exploring the world of currency trading and wanted a concise, intelligent and straightforward book. A summary of lessons learned or reinforced and some quotes from the book are detailed below. Audience – Readers who want an introduction to currencies and novice traders would benefit from the book. It is written for beginners but also briefly introduces some intermediate concepts. Title – The title is a good description of the content; the subtitle is perhaps grandiose (I find that many books have titles that are created by marketing departments to shift units and don’t fit the content). Disclosure – nothing to disclose, I do not know Kathy and have no affiliation with her nor BK Forex Advisors nor GFT. I bought the book myself on Amazon.co.uk. If you go the “Gift Shop” section of http://stoictrading.wordpress.com you can click through to Amazon.com or Amazon.co.uk to purchase it. Lessons Learned or Reinforced in The Little Book of Currency Trading Trade Management: Use a dual target method to exit trades – a conservative first target and a more ambitious second target. Everyone talks about the value of following the trend, but almost no one actually does it - one of the great ironies of forex trading. stoictrading.wordpress.com February 2012 2 Trade Identification: The four most important news items: central bank announcement, employment reports, retail sales, and manufacturing and service sector data. Watch out for highly correlated trades. Trading Plans & Record Keeping: Keep separate plans for short term trades and long term trades. Psychology: A trader is (more) rational when evaluating a trade set-up than he can possibly be while in a trade. Planning each trade and documenting the plan in a rational state is key, then hope your less-rational self follows through executing the plan. Quotes from The Little Book of Currency Trading P21. “If you […] invest exclusively in the […] stock market and could care less about exchange rates, it may be time to wake up.” P44. “Back when markets crashed in 2008, it was very difficult for speculators to short into a rapidly falling market (countries like the US require an uptick before a stock can be shorted). One possible way to participate in the sell-off at the time would have been to buy U.S. dollars and Japanese yen because there is no uptick rule in the forex market; in times of overwhelming nervousness, low yielding currencies are in big demand. Investors who wanted to offset their losses in stocks could have bought dollars and yen.” P74. “If stocks are rallying, it generally means that traders are optimistic and willing to take on risk, which is positive for high-yielding currencies.” P65. “When a political or social crisis hits a country, currency traders usually sell first and ask questions later because currencies are political as well as economic assets.” P67. “Where interest rates are headed is single-handedly the most important long-term driver for currencies.” P71. “Aside from the central bank announcement, which can also be traded on an intraday basis, the top three most market-moving economic data for any country are: employment reports, retail sales, and manufacturing and service sector data. P72. “While the employment report tells how consumer spending could fare, the retail sales and consumption reports tell us how consumers actually behaved. The employment report is usually released before the retail sales report, which is why it can have a greater impact on the market.” P90. “Everyone talks about the value of following the trend, but almost no one actually does it. This is one of the great ironies of forex trading.” P100. “Not only have I met many traders who say that the T1-T2 method [dual target method] has transformed their returns but I use this method in my own trading. The idea is to have a conservative, relatively easy-to-achieve first target and a more ambitious second target.” P106. “Of the hundreds of technical indicators our there, the Double Bollinger Bands are hands down my favorite.” stoictrading.wordpress.com February 2012 3 P136. “Fundamental and technical indicators as well as market sentiment are three factors that can affect every trade. If you can wait for those factors to line up in your favor, you have a far greater chance of reducing your risk and landing a potential profit.” P147. From the Top 10 Mistakes: “#1: Trading out of Boredom or Anger.” P149. “#3: Taking Highly Correlated Trades.” P152. “#6: Being Too Patient with Losers and Not Patient Enough with Winners.” P167. “If you are serious about being successful at currency trading, there is no need to rush because the market will still be waiting for you three months from now.” P171. “In life, what separates professionals from novices is that professionals are always prepared. They do more homework than necessary just in case the unexpected occurs. A trading plan is the equivalent of any other professional’s business plan. Smart traders know that they are more rational when evaluating a trade set-up and less rational once the trade is unfolding.” P174. “Every trader should have a trading plan for short-term trades and another for long-term trades.” P174. “I create my trading plan on the previous day, listing the currency that I plan to trade.”